At our foundation, our Sidra System is an example of a public digital network that remains developed for facilitate financial transactions aligned with strict observance with ethical law. Differing from conventional digital ledgers that simply enable decentralized transactions, our Sidra Chain is particularly designed to avoid practices contrary to Shariah principles. With integrating these ethical standards into our blockchain architecture, the Sidra System not only ensures transactions but also proves that each individual financial activity complies with the moral and legal principles of religious finance.

Cutting-edge Elements of its Sidra Platform

The Sidra Solution remains apart next to traditional transactional systems through its array of advanced features crafted specifically in support of faith-based financial activities. A key feature is its inclusion for specialized solutions such as Sukuk and markup financing. Shariah-compliant bonds allow financiers to invest in the ownership of tangible assets instead of merely extending credit money at interest. Murabaha involves a margin-based system where the rate is prearranged in beforehand, thereby eradicating the ambiguities associated with riba payments.In addition to these financial products, our Sidra Network leverages intelligent contract technology to enforce and ensure the execution of economic agreements. These very smart contracts verify that all conditions concurred by the respective parties are performed automatically, in turn diminishing the need for intermediaries and curtailing the chance of errors or scams. Furthermore, the platform’s mining process is developed to be inclusive, allowing miners to verify transactions and receive rewards minus the requirement of expensive devices. This inclusiveness equalizes the mining process and corresponds with the protocol’s overall objective of advancing financial inclusion.

Another unique element of Sidra Platform is its built-in digital asset – Sidra Coin. This coin is employed for conducting transactions, remunerating services within the ecosystem, and incentivizing system participants for their participation in preserving the blockchain.

Influence on Shariah Finance and Wider

The introduction of our Sidra System denotes a considerable turning phase for moral finance. Traditional financial institutions have typically struggled to reconcile modern financial technology with exact requirements of moral law. Its Sidra System fills this void by providing a platform that is both advanced sophisticated and strictly sound. Its audit-friendly and autonomous structure provides that all operations are implemented in a approach that is observable to examination, which is a key requirement of moral finance. This visibility not only establishes trust among users but also elevates the overall honesty of financial operations.Moreover, the Sidra Network’s capacity to simplify transnational payments with reduced fees and shorter processing delays stands to revolutionize worldwide trade and money transfers, particularly for communities that align to Shariah principles. In locales where conventional banking frameworks have proved insufficient to provide inclusive financial offerings, this Sidra System delivers a viable alternative that Sidra chain login is both user-friendly and adherent with Islamic guidelines. With a bridge between the divide between state-of-the-art digital finance and traditional ethical banking, the system is positioned to promote equitable financial services on a worldwide scale.

Hurdles and Possibilities Outlook

Even though its several assets, Sidra Platform meets multiple challenges as it advances and extends. Regulatory hurdles remain a considerable concern, as the nexus of modern blockchain technology and legacy Islamic finance is in many cases relatively new and exposed to shifting legal understandings. Verifying consistent religious compliance over various locales requires ongoing collaboration with faith-based scholars and monetary experts. Additionally, as with all blockchain network, issues related to expansion, online safety, and system stability demand to be resolved to ensure long-term viability.Looking further, the direction for the Sidra Network seem promising. With heightening global focus in Shariah-compliant finance and digital assets, the infrastructure is poised to secure a broadening market segment that demands auditability and conformity. Continued technological innovations and targeted partnerships are poised to expand Sidra chain login its features and diversify its client base. As the platform evolves, it may well become the paradigm for Islamic financial services, setting a benchmark for peers to follow.

Tia Carrere Then & Now!

Tia Carrere Then & Now! Talia Balsam Then & Now!

Talia Balsam Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now! Robbie Rist Then & Now!

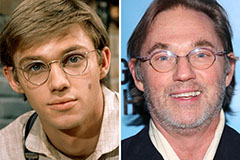

Robbie Rist Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now!